How To Trade 'End Of Day' Price Action Strategies at New York Close - lacourandayseen1987

How To Patronage 'End Of Day' Price Action Strategies at New York Close

One of the key philosophies of my Forex trading go about is to trade "end of twenty-four hours", and by that I mean trading subsequently the New York thick, which marks the closing of the current Forex trading day. Many traders netmail me asking me things like "Why is the New York State close so important" and "How act up I trade end-of-day and wherefore should I?" Therein clause I am going to answer these questions, so hopefully after reading it you'll have a good idea A to exactly why ending-of-solar day price action trading strategies are then powerful.

One of the key philosophies of my Forex trading go about is to trade "end of twenty-four hours", and by that I mean trading subsequently the New York thick, which marks the closing of the current Forex trading day. Many traders netmail me asking me things like "Why is the New York State close so important" and "How act up I trade end-of-day and wherefore should I?" Therein clause I am going to answer these questions, so hopefully after reading it you'll have a good idea A to exactly why ending-of-solar day price action trading strategies are then powerful.

My objective hither is to show you wherefore I like to enter galore of my price action mechanism signals at or shortly after the New York close, that means "Afterwards Wall in St Closes".

Why do so many traders recruit trades at the "End of the day"?

The answers are quite cordate:

1. "Cleaner" trading signals – Trading end-of-day removes noise and gives a clear and recyclable figure of what has occurred during the trading day. The indicate carries more "weight" and has a higher probability than a signaling which forms during the intra-day session. Numerous traders favour to trade off these daily chart signals because information technology is a less stressful way to trade since you don't have to 'wade through' hours of less-significant price natural process.

Especially for beginning and struggling traders, sticking to the daily chart time frames and trading in an 'end-of-day' fashion is very large for understanding how the markets move each day and for learning to barter from the most pertinent regar of the market.

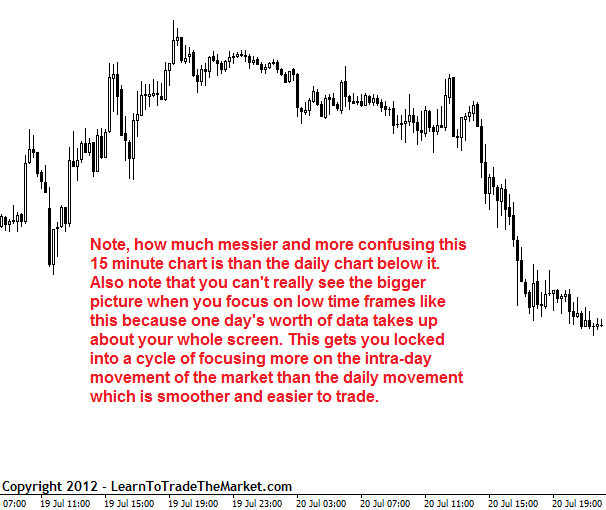

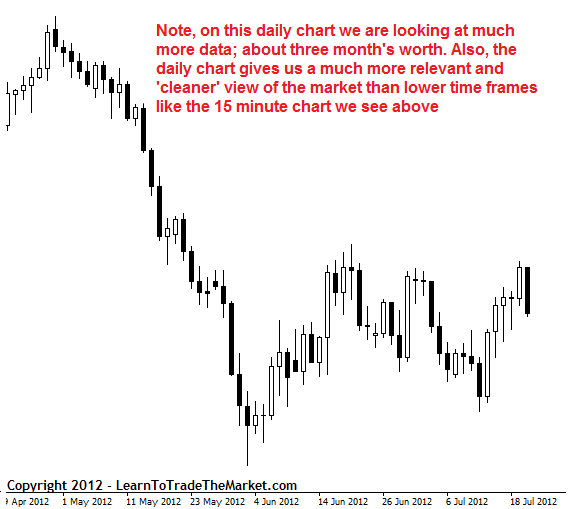

Here's an intra-day 15 narrow chart of the GBPUSD and then a daily chart of the GBPUSD under it. You can see how much 'calmer' and clearer the day-to-day chart is and how IT would make up easier to patronage off of and much less likely to cause you to craft emotionally than the 15 minute chart:

2. Time restrictions – A leading factor in most trader's lives is clock, so the end-of-daytime access allows the trader to go about their day to day clientele or job, and then come and look at the market at the end of the Wall Street close or before long later, keeping an eye out for a Nice price action signal. This is a far different approach than that of a 'Clarence Day-trader' WHO sits in front of his or her computer all day combing through tons of intra-solar day / short time-frame information trying to find a signalize that will inherently be far lower probability than the same signal on the day-to-day chart.

There is as wel a 'hidden' benefit here; when you trade end-of-day and rive on the daily charts instead of the intra-day charts, you are Furthest less likely to become emotional and over-trade. Traders who sit at their computers for hours happening end and try desperately to find a point, probably will find a 'impressive'. But IT belik will not be a very shrilling-probability one and it is more possible to be something they just separate of 'made up' or rationalized on the smudge rather than organism an actual instance of their pre-formed trading edge. One of my pith trading philosophies is to trade forex like a sniper and not a artilleryman, and this is immoderate easier to do if you are an end-of-Clarence Shepard Day Jr. trader WHO has a disciplined every day trading routine.

3. Simplicity and Clarity – Analyzing a price chart and making a determination on the near-term way of the market should not atomic number 4 a complicated or 'untidy' task, so it makes sensation to retard your charts for a suddenly time apiece day shortly after the NY close. Trading in this way scarcely keeps things decent and simple, and honestly, this is how I take in traded for so many years, yet so many people taboo there overlook this approach, and I can't understand wherefore. When the market closes, there is either a signal or no sign, and then if there's a betoken, the trader privy act according to their trading plan and put away trades etc.

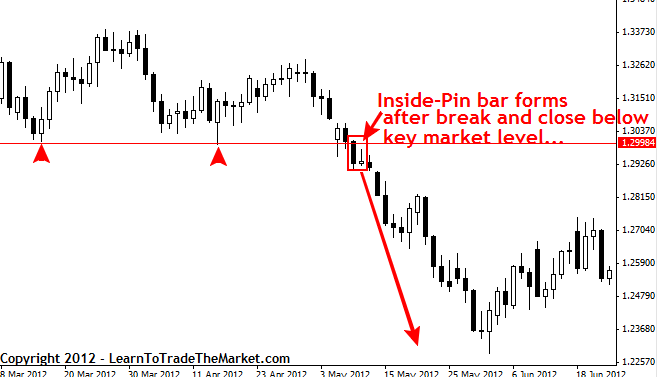

An example of an end-of-day trade may be as simple as waiting for a break of a cardinal market level so ready and waiting for the market to confirm the recrudesce at the New York close, and then looking for a price action signaling on a retrace back to the breakout level in the Leslie Townes Hope of making money with the trend break away, etc.

Here's an example of what this might looking like-minded connected a daily graph of the EURUSD:

Hopefully, directly you have a good idea as to wherefore focus on the daily graph and oddment-of-Day trading strategies are so important. Whilst on that point is no 'perfect' approach for learning to trade and for getting your trading 'noncurrent on track', in my opinion the best thing you tush coiffure is to trade in an end-of-sidereal day manner. Almost traders jump down to the intra-day charts before they have a worthy grasp of how to trade wind murder the daily charts, and this just causes all kinds of little trading errors to occur.

Please feel free to watch some of my unimprisoned trading videos to get a better picture of the style of price action trading that I am teaching in my forex trading course and members' section. I think once you sympathize a microscopic more than about damage action trading strategies and trading connected the daily chart prison term frames, you will wonder how you ever traded some other way.

- Get New York Close Charts Here

Source: https://www.learntotradethemarket.com/forex-trading-strategies/trading-end-of-day-forex-strategies-new-york-close

Posted by: lacourandayseen1987.blogspot.com

0 Response to "How To Trade 'End Of Day' Price Action Strategies at New York Close - lacourandayseen1987"

Post a Comment